All-in-1 solution for your Recurring Payments

Do you offer subscriptions? Or products that your customers pay for in installments? With Recurring Payments from PayPro, you easily collect subscription and installment payments via SEPA direct debit. Safe and simple.

Easy & Powerful

Whether you use the payment page, integrations, API or batches.

Full flexibility

Adjust the SEPA Direct Debit revolving term at any time.

Debtor management

Ready-to-use debtor management process to support.

Anti-fraud measures

All transactions and data are secured and encrypted.

Configured & Operational in an instant

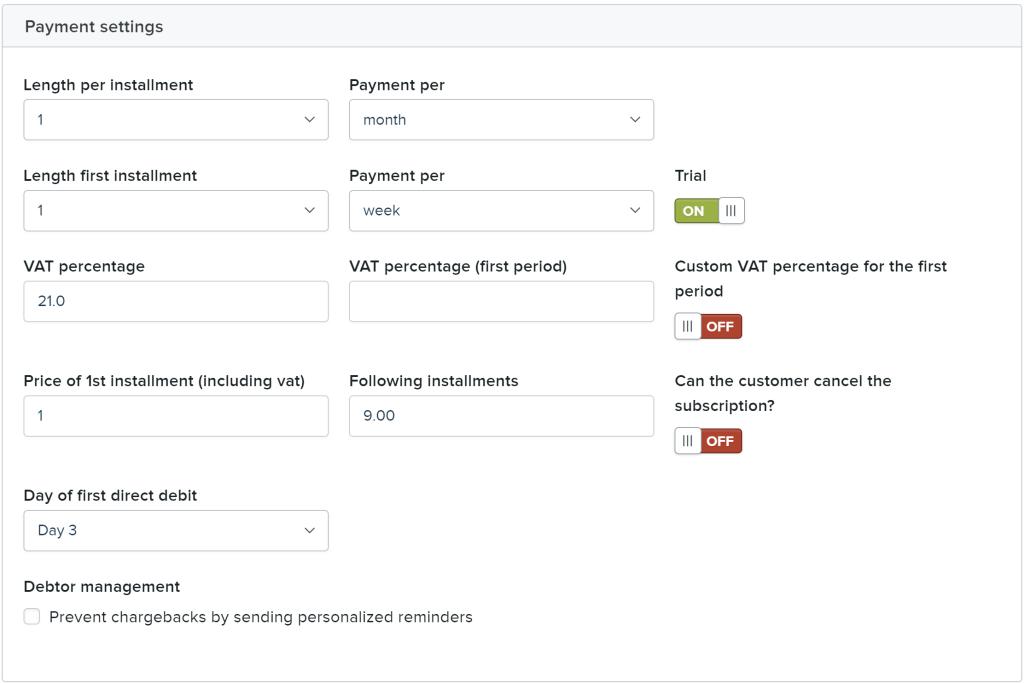

Recurring Payments through PayPro are easy, flexible, and powerful to use. For example, you determine the term, amount, and any different initial term. Once you have created an account, we put everything in place behind the scenes as quickly as possible so you can experience the power of recurring payments via PayPro usually within 1 business day.

Grow your customer base with ease

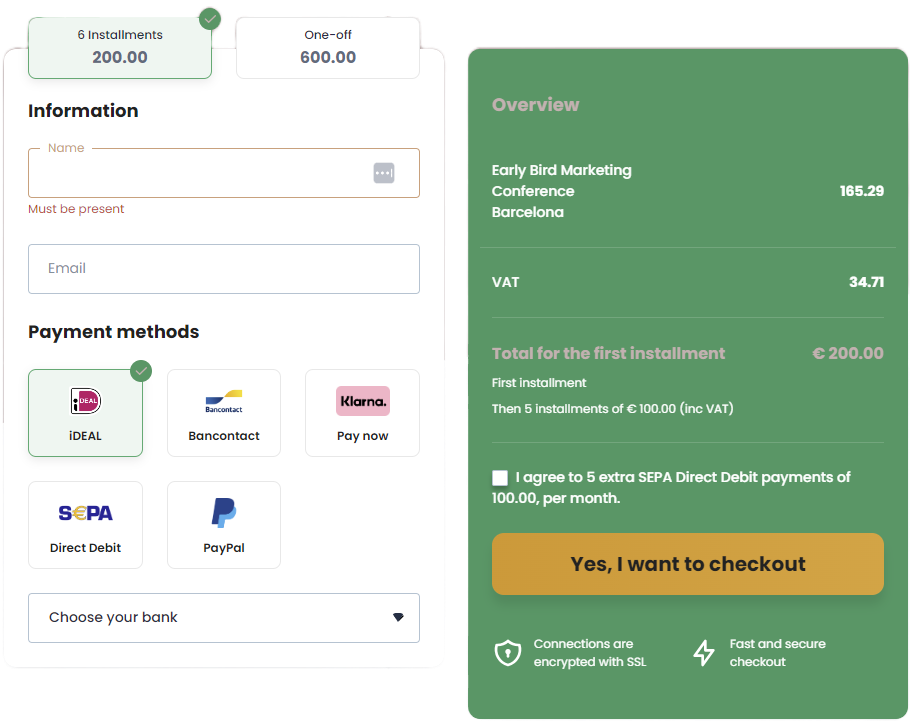

You can initiate subscriptions and installment payments through our payment page, API, by submitting batches, or by manually entering new subscriptions into our system. Do you want to migrate large customer files? Then we will help you with the migration.

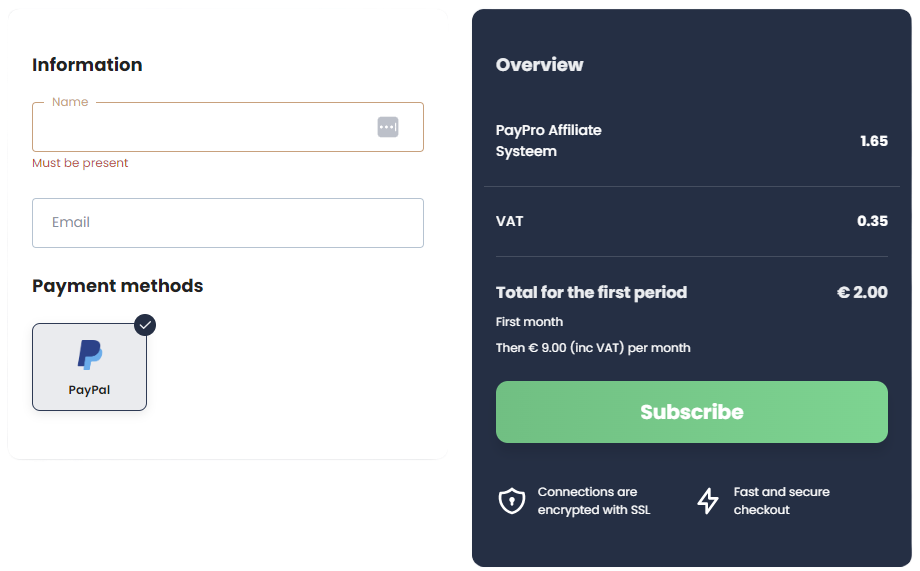

Payment Page

Sell your subscriptions through PayPro’s payment page and have your first installment paid right away with. We collect subsequent installments via SEPA direct debit, PayPal or CreditCard.

Discover our payment pageSEPA Batches

Import batch files from your favorite software that contain the amounts to be collected and required customer information.

SEPA Batch ImporterSubscribers dashboard

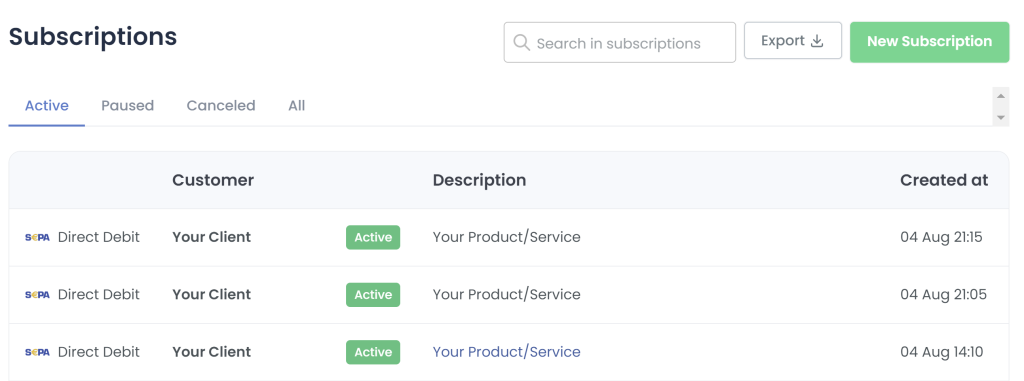

Add new subscribers to your PayPro account and set the subscription price, collection period and other terms yourself.

API

Use the PayPro API to create subscription or installment payments from your website or app.

Full control

Manage your recurring payments from one central dashboard. Pause, resume or terminate subscriptions with just 1 click.

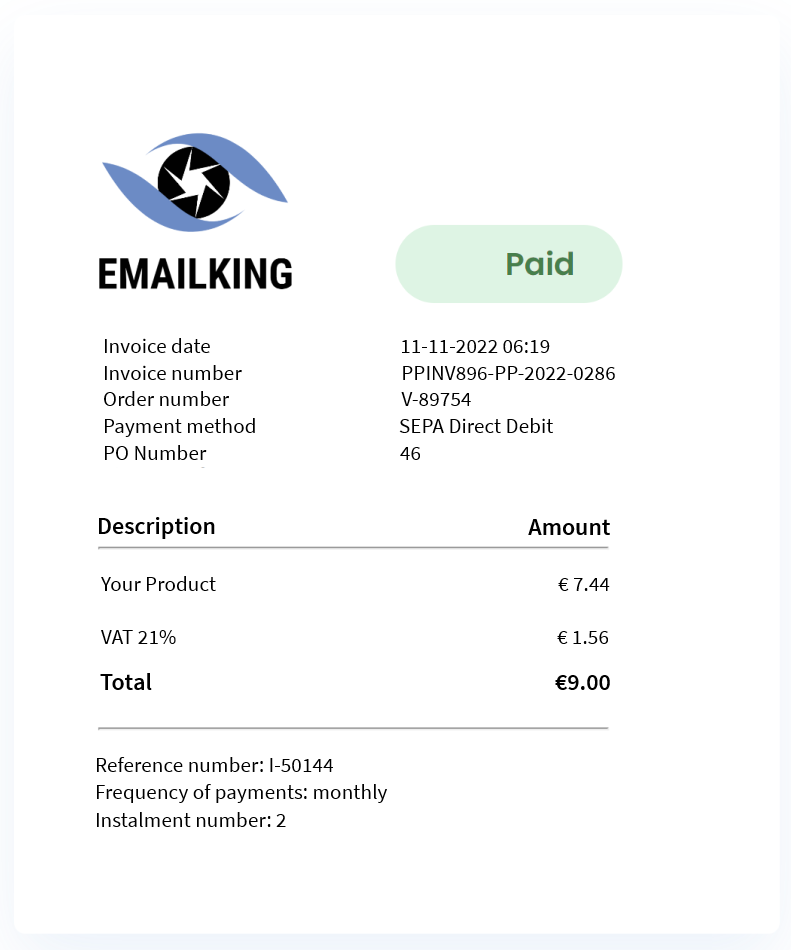

Automatically send an invoice for each payment

Save yourself the administrative hassle involved in invoicing for subscriptions and installment purchases.

After each sale, or even separately at your request, an invoice can be created and sent to your customer. The invoice contains all required tax information, plus anything else you wish to add.

- Automatically generated

- Style the invoices to match your brand identity

- For each direct debit

Minimize lost sales with a proven accounts receivable process

Allround Crossfit subscription

If your client defaults, PayPro goes after your money. PayPro has a ready-made debtor management process in which we send your client reminders and demands so that the client still pays as soon as possible. More than 90% of the unwanted collections we manage to secure for you.

- Reminders & dunning by email

- Payment link in the email to settle outstanding invoices straight away

- Transferable to collection agency

Trusted by more than 10,000 businesses since 2006

Experience our Recurring Payments platform 30 days for free

Start-up

Receive up to 20 transactions per month. Generate additional sales with Affiliate Marketing.

- up to 20 transactions per month

- Payments in Installments

- Subscriptions

- Payment Page

- VAT Accounting & Reporting

- Billing

- Affiliate Marketing

Professional

Receive unlimited one-time and recurring payments. Generate additional sales with Affiliate Marketing and all conversion increasing features.

- Unlimited transactions

- Payments in Installments

- Subscriptions

- Debtor Management

- SEPA Direct Debit Batches

- Payment Page

- Discount Codes

- 1-Click-Upsell

- OrderBump

- Custom Domain

- VAT Accounting & Reporting

- Billing

- Bank Wire Transfer

- Notifications for clients

- Affiliate Marketing

Enterprise

Design a custom package. Available for businesses with large payments volume or unique business models.

Frequently Asked Questions

The Start-up package allows you to receive one-time and recurring payments. If you receive only one-time payments, your Start-up package is immediately converted to an Advanced package. If you have recurring payments, your Start-up package will be converted to a Professional package. You can then receive an unlimited number of transactions per month and also benefit from all the other (conversion increasing) features that the Advanced and Professional packages offer.

As a payment service provider, PayPro, like other payment service providers, charges a transaction fee per transaction. After all, processing an iDEAL transaction, for example, involves costs. We charge these to you, just like any other payment service provider. However, the subscription price of the Advanced and Professional packages never changes, no matter how many transactions you have processed. Unlimited really is unlimited!

The overview of transaction fees can be found here:

Transaction fee overview

However, PayPro goes beyond 99% of all affiliate marketing software and networks. In fact, PayPro offers the ability to pay out affiliates immediately, or after your approval, after a sale or conversion and send the credit invoice by email. This ensures a fast and efficient cash flow between you and your affiliates. So you don’t have to do anything yourself.

Instead of paying out your affiliates periodically yourself, PayPro handles the financial and administrative side of working with your affiliate.

In addition to administrative convenience, PayPro also enables you to get more success out of your affiliate marketing channel. Thanks to our powerful affiliate network with more than 150,000 affiliates, you create the perfect starting point to achieve success with affiliate marketing.

Affiliate Marketing is possible with the ‘Start-up’, ‘Advanced’ or ‘Professional’ package. For using the affiliate network and paying your affiliates directly, PayPro charges a market-based fee per transaction.

Overview Affiliate Marketing fee per transaction

Do you have other questions? Get in touch with us